Family business set to soar after debt consolidation

The Froling family* runs a locksmith business in regional South Australia. Like many families, they are feeling the pinch of higher interest rates on their loan repayments.

The family overcame a troubling time years ago when father Doug was injured in a car crash. He could not work and almost had to sell the business.

Doug’s injuries distracted the family from their mortgage. The Frolings did not seek a rate review as the interest rate climbed to 6.60%pa. The family then missed repayments. They also resorted to using credit cards.

Thankfully, their locksmith business has since picked up significantly. Earnings have improved, and the family sees opportunities it would love to take advantage of in the market.

The Frolings would like to refinance to free up cash and seize these opportunities. However, a number of lenders declined due to the family’s debt and repayment history.

Through the local business chamber, the Frolings met a broker keen to learn more about their challenges.

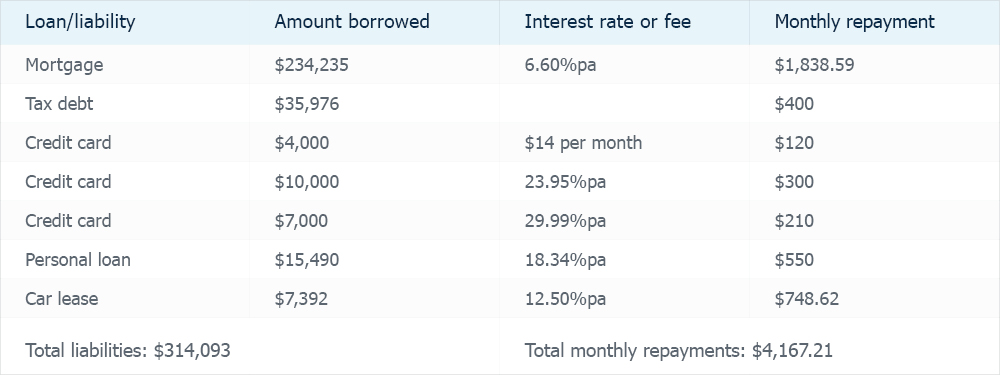

Here are the family’s monthly repayments for their loans and liabilities:

The broker realised the Frolings are eligible for Resimac’s Specialist Alt Doc Plus product. This has a variable rate of 5.89%pa due to the LVR of 49.2%.

She explains that by refinancing their home loan with Resimac for a larger amount, the Frolings can pay out all of the other loans (ie consolidate their debts into the mortgage). This enables them to repay their debt at the substantially lower Resimac mortgage interest rate.

For example, rather than continue to repay their credit card loan amounts at 29.99%pa and 23.95%pa, the family can repay these to Resimac at the 5.89%pa rate. This is debt consolidation at work.

The final figures promise the improved cashflow the Frolings have been looking for.

By taking out a Resimac home loan of $320,000, the larger amount will allow all remaining debt to be repaid at the lower Resimac interest rate.

The family’s monthly repayments have been slashed from $4,167.21 to $1,895.99. That is less than half of what they were paying previously, freeing up a whopping $2,271.22 a month (or $27,254 a year) that they can invest into their business and perhaps pay off their home loan ahead of schedule.

To learn more about how debt consolidation can help your clients, talk to a Resimac BDM: https://broker.resimac.com.au/about-us/our-bdms.

* All names and occupations are fictious and are for illustrative purposes only.